Invest in Gold with Confidence

Learn and apply the exact system a seasoned investor uses to build lasting wealth — even if you’re brand new to gold investing.

The Gold Program isn’t another fund where your money disappears into someone else’s control. Instead, it’s a step-by-step system that helps you build your own gold portfolio — tailored to you, guided by an experienced investor.

You’ll learn how to protect what you already have, grow your wealth, and secure allocated gold that’s safely stored and insured with trusted dealers. Plus, you’ll get expert insights into the exact companies and funds that can help you strengthen your portfolio with confidence.

“I’ve worked with Simon for several years and find his knowledge about investing to be invaluable. Even though I was recently leading the Daily Telegraph tipping competition, I’m always keen to learn more about investing and have found Simon’s knowledge and guidance to be incredibly useful.”

- Priyesh P., Milton Keynes

Inside The Gold Program

The Gold Program is a course to invest in Gold. When you get it, I’ll not only talk you through the system I use to invest, but let you have it. You’ll also sit down with me for a private 1:1 Zoom session where I personally walk you through the exact process I use to invest in gold and grow my own portfolio. This is the first step of the course.

I’ll break down my full approach to gold investing, from spotting opportunities in the market to knowing when and how to take action. This isn’t theory — it’s the system I’ve refined through years of investing, and it’s the same one I use today.

I’ll share a list of companies and funds that I use in my own portfolio, so you’re not left guessing.

By the end of our session, you won’t just understand The Gold Program system — you’ll have a clear, personalized plan for using it yourself, built around your goals, your risk level, and the wealth you want to create.

Plus, to Keep You on Track…

12 Months of Fortnightly Gold Reports

To help you on your journey, you’ll also receive support with my fortnightly reports. These will help you not only get a better understanding of the system but also help you review it and decide whether you want to make any changes.

It also covers other ways that you may want to invest in Gold.

The Gold Program System Workbook

When you sign up you’ll get a list of companies to build your own investment portfolio using the system. During our 1:1 session, I’ll show you how to use the system to suit you. It will be your personal workbook — a practical tool where you can map out your investments and put everything you’ve learned into action.

“I have worked with Simon for about 5 years now and I’m always impressed with his deep knowledge of gold, silver, miners, and commodities in general. It’s fair and accurate to say that you’d have to go a long way to find a guru with more knowledge of the sector than Simon. I’d certainly recommend him for anyone looking to expand their knowledge (and investments) in this sector.”

- Greg R., Knaresborough

Next-Level Bonuses - That you get with The Gold Program

Once you’ve got the foundations of The Gold Program system in place, you’ll also unlock two powerful bonuses to help you take your investing even further:

Bonus #1: Free Access to Edison Research

When you’re ready to dive deeper, you’ll have free access to Edison Research. This is an advanced resource I use to carry out detailed analysis into the gold market. It’s an incredible way to strengthen your decision-making as you continue applying the system.

Bonus #2: A Free Pass to Mines and Money (Now Called Resourcing Tomorrow)

You’ll also get a complimentary pass to Mines and Money — one of the gold industry’s leading events. It’s the perfect chance to learn from top experts, connect with other investors, and gain insights that you simply won’t find anywhere else.

These FREE BONUSES ensure that more advanced investors can still benefit from the Gold Program

PLUS: Get These Free Gifts

The Six Pillars of Investing

This short guide shows you the exact framework I use to evaluate any investment opportunity. With these six pillars, you’ll learn how to think like a seasoned investor and quickly spot whether an opportunity is worth your time. Use it to cross-check your own selections and make smarter, more confident decisions.

The Beginner’s Guide to Investing in Gold

This eBook is designed to give you the solid foundation every gold investor needs. Inside, I’ll not only show you how to start investing in gold, but also the why behind every step, so you fully understand the reasoning that drives smart decisions. It’s the perfect companion to The Gold Program system, helping you build clarity and confidence right from the beginning.

Where the Big Funds Are Investing

Ever wondered where the big players are putting their money? This guide gives you an inside look at how professional funds are investing in gold right now. It’s a powerful reference to use alongside The Gold Program system, helping you spot opportunities with the same perspective as the pros.

“I first came across Simon when he was writing “Metals and Miners” for Moneyweek. I’ve worked with him ever since, and despite having a very successful career in private equity, I’ve found that his insight into investing is not only helpful but also very profitable.”

- Vincent S., Weston Super Mare

Why invest in BOTH physical gold and gold mining companies?

There are two key reasons I combine physical gold with investments in gold mining companies inside The Gold Program system:

1. Physical Gold Protects Wealth

Physical gold is the ultimate store of value. It holds steady when markets wobble and gives you a secure foundation in your portfolio. As current gold price projections suggest, there’s strong potential for prices to rise further — which means even more upside for long-term holders.

2. Mining Companies Amplify Growth

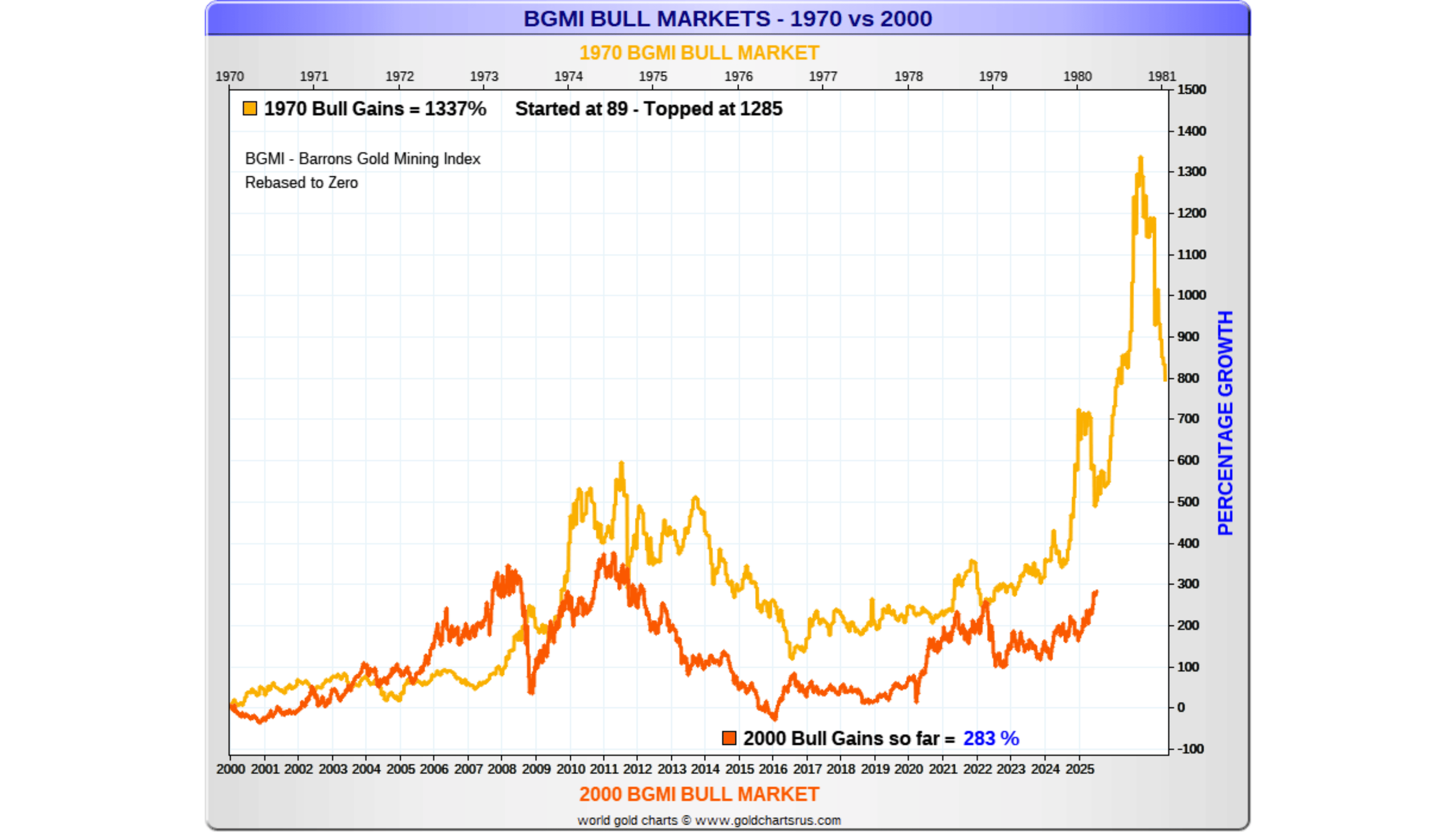

Gold mining companies don’t just track the price of gold — they can multiply it. When gold enters a strong bull market, miners historically deliver much bigger returns. Just look at the Barron’s Mining Index: when you compare today’s market with the 1970s bull run, the growth potential is clear. If history repeats itself, we could be looking at huge gains ahead.

“I’ve known Simon for over 20 years and regularly speak with him about my investment strategy. Over the years, he’s not only helped me make a lot of money, but also save a lot. I thoroughly recommend his work.”

- Andrew Cadell, Burley

How Does The Gold Program System Perform?

I don’t just talk about theory — I show you results. This graphic tracks two example portfolios built using The Gold Program System (which you get when you buy The Gold Program)

Portfolio A: Up 33.2% in just over 3 months

Portfolio B: Up 34.4% in the same period

These portfolios don’t reveal the individual company names (that’s what I share with you inside the program) but they do give you a clear picture of how effective this system can be as an investment strategy.

Of course, no investment comes without risk, and past performance doesn’t guarantee future results. But these returns show what’s possible when you follow a proven, disciplined system for investing in gold.

Why Build Your Own Investment Portfolio?

You could hand your money to a broker or park it in a generic investing app — but then you’re stuck with cookie-cutter choices that don’t reflect you, your goals, or your appetite for risk.

With The Gold Program system, you design a portfolio that’s truly yours. That means:

The risk level you want — whether you prefer steady security or are comfortable taking on more upside.

The income you want — you can choose companies that pay dividends if regular income matters to you.

The currency exposure you want — diversify away from currencies you’re already tied to.

The countries you want — gain exposure to global markets, not just your own backyard.

The commodities you want — many gold producers also mine silver, copper, or other valuable resources.

I want you to Build a Portfolio That Reflects You

This isn’t a cookie-cutter fund. Using the system you can put together a portfolio designed around your strategy, your goals, and your appetite for risk.

The bottom line: This system helps you build a portfolio that reflects you. One that matches your strategy, your goals, and your long-term vision.

Ready to Start Your Gold Investing Journey?

You can get the entire Gold Program system right now for just £395.

Here’s how it works:

Buy it today and get instant access to the system - put a portfolio of investments together (the system gives you everything you need) that can start making you money NOW!

I’ll personally get in touch to schedule your 1:1 session at a time that works for you. Together, we’ll walk through the entire system, step by step to make sure you’re confident to get started.

You’ll stay supported with your workbook and 12 months of fortnightly reports to keep you on track.

You don’t have to figure this out alone. When you invest in The Gold Program system, you’ll have a proven process, expert guidance, and ongoing support to help you invest in gold with confidence.

Disclaimer: The Gold price and Gold mining equity prices go up and down and there are no guarantees that you will make money with The Gold Program, you should speak with a qualified financial advisor before making any investments.

FAQs

-

Initially, you should have at least £1,000 with a view to allocating over £5,000 to gold and gold investments.

Over time you can build on your portfolio, but you need to be able to invest a meaningful amount of capital, with a view to being able to invest more.

I need to be clear that I don’t touch your money. I simply show you how to convert some cash to gold and how you can put your own portfolio together.

I help you construct something that’s right for YOU. Remember, the aim is really simple - to protect what you already have with physical gold and grow your wealth through a diversified range of investments.

Important: You must speak with a professional financial adviser before buying or selling any financial products

-

Once you are signed up to The Gold Program then drop me a line at simonpopple@brookvillecapital.com and we will set up a call. The call will last 30 – 45 minutes.

-

If you don’t see a benefit of 8% (across your entire portfolio) after 10 months, then please arrange a call with me to see if I can help.

I would like to know what set up you have in your portfolio (how many defenders, midfielders, forwards etc) as well as what you’re aiming to do.

It’s important that you follow the system that I set out using a Fantasy Football set up (which includes a Stadium – Physical Gold as well as a Training Ground – a Fund).

-

If you get stuck or have a problem after you’ve signed up, then let’s have a call. It’s important for me that you understand what to do.

-

Although the Gold price has grown by an average of over 10.6% per year since 2000, there are no guarantees on returns. ALL investments require taking risks. If you’re not comfortable taking ANY risks then The Gold Program is not for you.

You should always speak with a Financial Advisor to get advice before buying or selling any shares.

-

Of course, if you’d like to have a chat before investing then please get in touch. The only thing I’d say is that you probably need to invest at least £5,000 with a view to investing more (you do this yourself, I don’t touch your money). So if you’ve got less than this then I’m afraid this is unlikely to be suitable for you.

I like people to have enough to take several positions, so they’re diversified. With less than £5,000 it’s difficult to do this.

-

You get the bonuses as soon as you sign up. If I buy physical gold do I need to take delivery of it and insure it? Although you can choose to get it delivered to your home and insure it yourself, I’d strongly suggest that you buy it from a dealer who can store and insure it on your behalf (a lot can do this). This saves you the hassle of getting suitable storage at home (such as a safe) as well as having to deal with your insurers.

I never take delivery of ANY of my gold or silver.