Can I Have Gold in My Pension?

If you’re wondering whether you can hold gold in your pension in the UK — the short answer is yes, but only under certain conditions.

In this quick guide, I’ll explain how gold can be included in a pension, which types of pensions allow it (like a SIPP), and what to consider before adding physical gold to your retirement strategy.

Rules for Having Gold in Your Pension

As of 8th July 2025, I’m pleased to say that you can hold physical gold within a Self-Invested Personal Pension (SIPP) or a Small Self-Administered Scheme (SSAS) — but there are important rules to follow.

✅ The gold must be:

Investment-grade bars (minimum purity: 995 parts per 1,000)

Securely vaulted

🚫 Not allowed:

Gold coins

Jewellery

Unallocated gold

Your gold is owned via your pension.

The good news: I can introduce you to a reputable gold dealer who handle compliant pension gold investments. They know all about it and can field any questions that you may have.

More on that later.

Related: How Can I Try and Get Over a 10.6% Return on My Money?

Why Add Gold to Your Pension?

Gold has long been considered a store of value and is increasingly used to diversify investment portfolios. If your pension is already exposed to bonds, equities, and property, then why not add some gold too?

Here are two Eye-Opening Gold Facts for you:

1. Gold vs House Prices

📆 1920: Average US house price = $6,300 | Gold = $20.67/oz → 305 oz of gold to buy a house

📆 2025: Average house price = $450,000 | Gold ≈ $3,225/oz → Only 140 oz needed too buy that house

That's less than half the gold required in 2025 vs 1920.

I must confess, I thought property prices had done very well, so I was a little surprised with these numbers, but very encouraged!

They’re impressive, right?

2. Long-Term Returns

Here’s another fact that surprised me. Between 2000 and 2025, gold rose on average by over 10.6% per year (in GBP). Not only is that way ahead of inflation, but it’s also a pretty good return.

If you play around with the numbers a bit, then £5,000 compounded at 10.6% for 25 years = £62,065

That’s a lot of growth.

Related: What Drives the Gold Price?

Why I Now Hold Gold in My Pension

I used to be comfortable holding mostly UK equities and bonds in my pension. But times have changed and I need to change with them.

Today, I want more diversification as well as trying to get some inflation protection as well. Not only that, but I like the idea of having some investments in tangible things in my pension.

I like the fact that you “can’t print gold”.

The other reason I like Gold in my pension is that it’s an international asset. What I mean by that is it’s viewed as being valuable literally anywhere in the World. As my house and pension are predominantly exposed to sterling, I like the idea of having something in my pension that’s not.

Sure, sterling could do very well, but if it doesn’t, I don’t want my retirement to be reliant on it. If sterling has a bad few years, it’ll be nice to have something in my pension that’s not exposed to it.

Again, I want more diversification.

The main argument I hear about not having gold in your pension is that it doesn’t generate an income. But I feel this is irrelevant for me as far as my pension is concerned. I’d view my pension as a long-term investment where I’m after capital growth — not income.

If you’d like some income, then it’s worth mentioning that you could also get some mining shares in your pension pot that pay a dividend. You can get shares in some very large gold companies with a market value over £20 billion, so you can not only get exposure to gold, but also any dividends as well.

If that might be of interest, then you may want to look at my Gold Program. This aims to get a better return than 10.6% per year from a wide range of investments. The 10.6% relates to the return I mentioned earlier.

You can check out The Gold Program for more information on this.

Anyway, back to physical gold in your pension!

There’s currently no Capital Gains Tax on gold held inside a pension. So should we get some decent growth in the Gold price, that physical Gold you invested in won’t incur Capital Gains Tax!

It’s also worth mentioning that there’s currently no VAT payable when you buy it.

Diversification

I want to revisit diversification, because I feel it’s an important reason why you may want to have some Gold in your pension.

Gold provides diversification in a portfolio and is often correlated with the stock market during risk-on periods (when investors are bullish), while it decouples and becomes inversely correlated during periods of stress (market downturns). This means its price tends to move in the opposite direction of stocks when markets are under pressure, potentially mitigating losses.

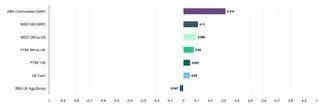

Here are some correlations between gold and many major market indices across various assets classes and time horizons to highlight how it behaves with those assets over various time horizons and market conditions.

If you’d list to find out more about correlation, you will need to set up an account with the World Gold Council (at the time of writing this blog - 12th August 2025 - it’s Free).

I like the idea of being diversified. If something happens in the World that scares the hell out of me. It’s likely to affect my investments. It could be good or it might be bad. What I like about gold is that if it’s something that causes say a market crash, then although that will hurt some of my investments….because of this correlation, my gold could do very well.

In times like these I’d probably view it just as much as insurance as an investment.

In case you’re wondering what a correlation is, it’s how an asset performs relative to another asset.

Here is a definition for you…..

“Correlation analysis is a statistical method used to evaluate the relationship between two variables, such as the association between body size and shoe size. The strength of this relationship is measured by the correlation coefficient, which ranges from -1 to +1.”

So a strong correlation would be 1. As you can see, the strongest correlation from the table is 0.315.

This suggests limited co-movement, reinforcing the idea of gold's diversifying potential.

By including gold in a pension, investors may be able to reduce overall portfolio volatility and manage risk more effectively, particularly during market downturns.

What About Delivery and Insurance?

A common reason that people don’t invest in Gold is they’re worried about taking delivery of it and storing it at home. But that’s a BIG misconception.

You DON’T need to take delivery of the gold — it can be vaulted, insured, and securely stored for you. So you don’t need to worry about getting a safe or dealing with insurers. Let the experts deal with that.

Want to Add Gold to Your Pension?

If you’d like to have some Gold in your pension, then you could always speak with the firm I use. The Pure Gold Company.

I obviously carried out some due diligence before using them and you should do likewise.

You’ll be encouraged to know that they are:

Associate members of the LBMA (London Bullion Market Association)

Members of the Royal and British Numismatic Association

Members of the British Chamber of Commerce

Featured in major media like the Financial Times, Reuters, Daily Mail, The Guardian, The Observer, The Wall Street Journal and MoneyWeek

Even if you're even just fact-finding, I’d suggest giving them a call. They know a lot about Gold and can be very helpful.

The Pure Gold Company uses Loomis International for storing their clients' gold. Loomis is a London Bullion Market Association member and a leading precious metal custodian, offering fully insured, allocated, and segregated storage in LBMA member vaults.

All I would say is that you would need at least £5,000 to invest, so it doesn’t make sense speaking with them until you’re in a position to make this kind of investment.

Click on the link below to find out more: