What Factors Drive the Gold Price Up and Down?

If you’ve ever wondered what actually drives the gold price (makes it go up or down) — you're not alone.

The truth?

There’s no one lever pulling the gold price up or down…but there are at least four forces that quietly shape every movement.

I call them MIDI.

And once you know them — you’ll never look at the headlines the same way again.

Let me explain.

M = Market Uncertainty

Geopolitics

Who wants to trade with who? This is vitally important for the world economy. Certain countries can produce things a lot cheaper than others.

If they limit who can get their stuff, it can cause huge issues in the Global Economy and drive the gold price up.

Tariffs

High tariffs make trade more difficult (expensive). Even if a country is prepared to trade with another, the tariffs that might be levied on certain goods could make it prohibitively expensive to do so.

Although there may be instances where the higher price will be absorbed, there are likely to be cases where it isn’t. What will happen to the gold price?

Wars

These obviously close markets and not surprisingly, can lead to great market uncertainty.

Situations can also be exacerbated if the US or China are considered to be particularly friendly with one side or the other. Although they may not directly be involved, their mere presence can have a significant impact on the outcome (for example, they may be prepared to provide weapons at attractive (or zero) prices).

Recessions

Are some countries struggling, perhaps there’s a global recession? This is another significant force driving the gold price.

People want a safe haven. And that’s when the gold price often ticks up. There are obviously no guarantees, but that “safe haven” appeal could make it more attractive for a lot of investors to buy physical gold or invest in mining companies.

The bottom line: When the world gets shaky, gold gets shiny.

I = Inflation

Simple maths: if your personal level of inflation is higher than the interest you get on your cash, you’re losing purchasing power. Your cash buys less.

Your savings may be ticking up in terms of “value” but they’re ticking down as far as purchasing power is concerned.

For example, say you’re getting 3% from the bank on your cash deposited with them, but if your personal level of inflation is 4% - you’re losing money.

Think of it this way. I lend you £100 at a 10% interest rate. At the time I can buy 10 of my favourite bottles of wine for that £100.

In a year you pay me back £110 (the initial amount you borrowed plus the interest), but (because of inflation) I can only buy 9 of my favourite bottles of wine.

As you can see, I’ve got more money (£110 rather than £100), but I can buy less with it (9 rather than 10 bottles of wine).

Before I go on with the last of the gold price forces, let me touch on what I mean by your “personal level of inflation”. The headline rate of inflation (that’s regularly published), is based on a “basket” of different things.

Two points to note here:

Firstly, you may spend your money in very different ways, so your “personal level of inflation” could be very different to this headline rate.

Secondly, as the headline rate is used to calculate public sector pay rises, there’s a logical argument as to why the government would like it to be lower rather than higher.

The Office of National Statistics use the consumer price inflation basket of goods and services (click on the latest Excel spreadsheet to see the basket).

If inflation is running high, sometimes people look for something that could offer not only a better return, but also similar liquidity to their cash. They don’t want inflation to erode the purchasing power of their cash.

This is where gold can outshine (excuse the pun!) many other assets (such as property investments), because of the simple fact that it’s liquid. Whilst it’s not as liquid as cash (you can’t literally get it out of a cash machine), you can normally sell it very quickly and get the cash in your bank account within days.

Not only that, but since 2000 it’s delivered an average annual return of over 10.6% in sterling – not bad for almost 25 years. It’s worth pointing out that this is significantly higher than the level of inflation.

You’ve got to do something to hold on to your purchasing power. If people choose to buy gold to do this, then logically, higher demand = higher gold price.

D = Debt

Rising debt isn’t just a stat—it’s a signal.

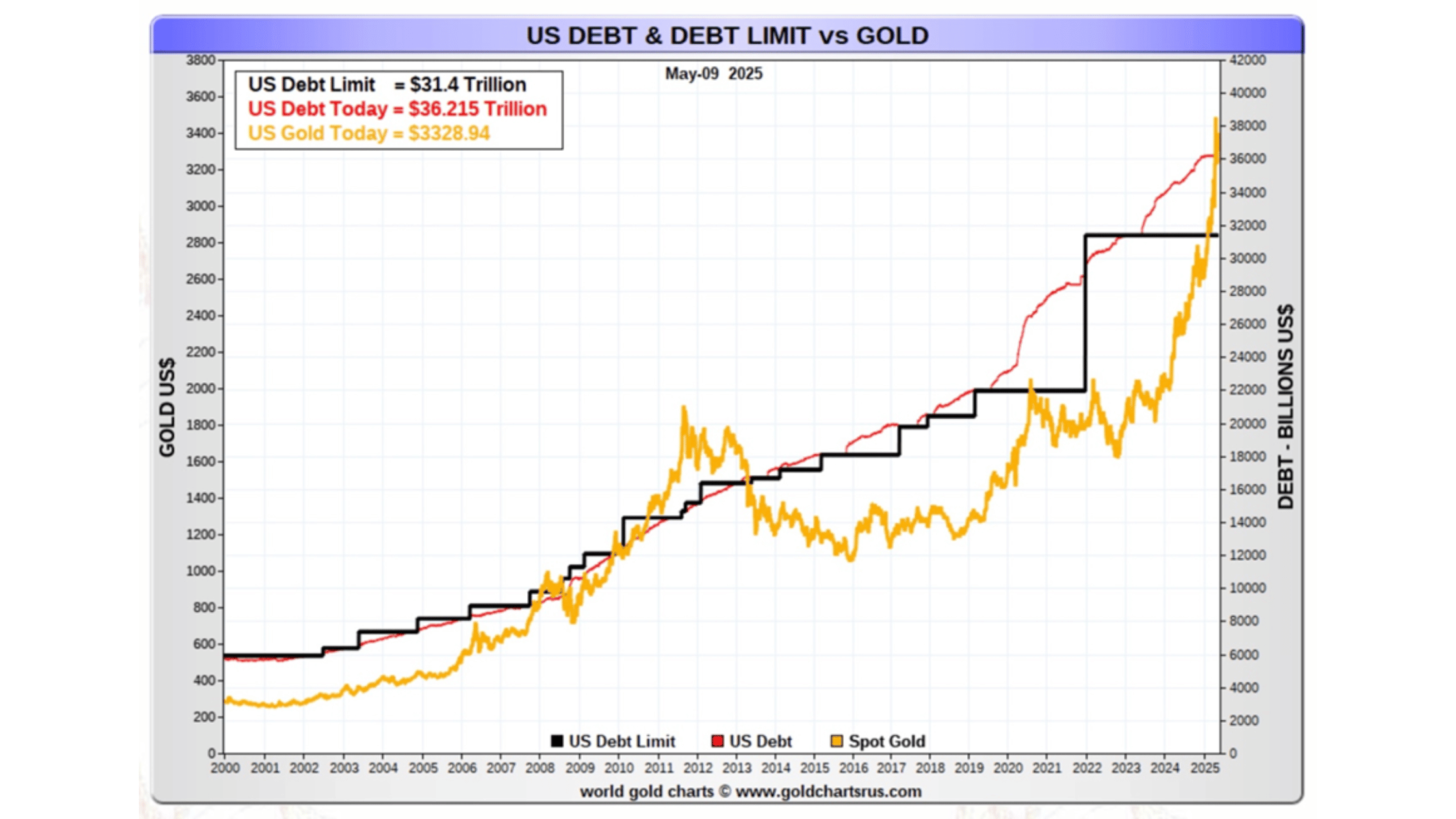

History shows a clear pattern (just look at the chart below).

As US debt climbs (the red line), over the longer term, the gold price (the gold price) tends to follow (gold prices go up and down – debt only seems to go up!)

And guess what? That debt isn’t slowing down.

Have you ever heard a convincing argument by anyone (especially a politician) that they’re going to materially reduce the amount of debt?

If debt continues to rise…what do you think will happen to the gold price?

I = Interest Rates

Gold doesn’t pay interest.

So when rates drop, the opportunity cost of holding gold diminishes.

Rates are expected to fall.

Think of it this way. You’ve got cash in the bank earning 3% interest, you may be ok with that (particularly if your personal level of inflation is less than 3%). But then interest rates fall and the bank drops their savings rate to 2%.

Suddenly — gold looks a lot more attractive.

You’re only foregoing 2% by having your cash in gold rather than 3% (don’t forget that physical gold does not pay any interest).

Lower interest rates leading to more interest (excuse the pun), in gold.

Remember MIDI.

Because when those 4 align… the gold price often moves with force.

Curious how it plays out right now?

Sign up to my FREE newsletter on LinkedIn for expert insights and updates every single week! When you click the link, you will be taken to a LinkedIn Page where you will also need to click Subscribe.