Is Gold a Good Hedge Against Inflation?

Gold is often viewed as a hedge against inflation, but the reality is more nuanced. Its performance depends on broader economic conditions, interest rates, and investor behaviour.

Why Gold Can Be a Good Hedge

Intrinsic Value: Gold is a tangible asset not tied to any single currency or government, so its value doesn’t erode directly when money loses purchasing power. You can’t print Gold.

Long-Term Protection: Over long periods, gold tends to retain its real value even as fiat currencies lose theirs. Here’s an interesting fact for you. In 1926 the average house price in the UK was £619 which equated to 146 ounces of Gold. Fast forward to 2025 when the average price was £269,000 which equates to less than 100 ounces of gold. In simple terms, Gold has outperformed property.

Safe Haven: During periods of high inflation or geopolitical uncertainty, investors often move into gold, higher demand with relatively fixed supply can drive up prices.

Related: How Gold Could Change Your Life

Why It’s Not a Perfect Hedge

Short-Term Volatility: Gold prices can swing significantly — sometimes even falling during inflationary spikes (e.g., early 1980s, 2022).

No Yield: Unlike stocks or bonds, gold doesn’t pay interest or dividends (although you can get dividends from some Gold mining companies). When interest rates rise, gold often underperforms. I must say, I particularly like it when interest rates are either historically low or falling. With the high levels of debt out there, it’s not difficult to see why politicians want to keep interest rates low in the hope that it’s easier to service the debt. They can then spend more money on things they hope will help get them re-elected! With debt rising I think it could be difficult to significantly increase interest rates.

Changing Correlation: Gold’s link to inflation isn’t constant; it sometimes moves more with the U.S. dollar or risk sentiment rather than inflation itself. Having said that, if you look at inflation over the years and compare that to the historical average annual return on Gold since 2000 – which is around 10.9% (in GBP), it’s clear that this is much higher than inflation.

Related: What Factors Drive the Gold Price Up and Down?

Historical Perspective

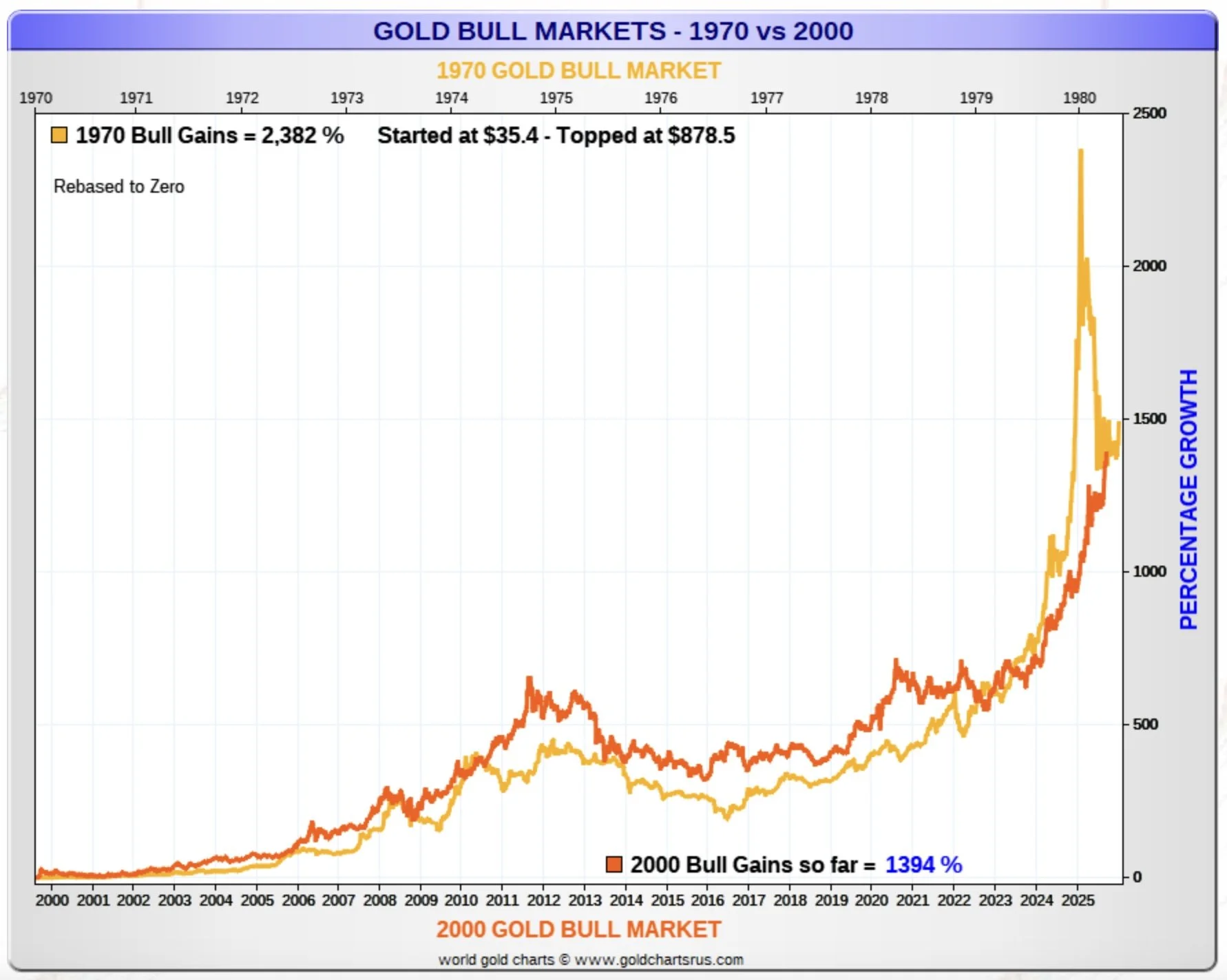

1970s: Gold performed exceptionally well as inflation surged.

1980s–1990s: Inflation cooled and rates rose, leading to weak gold performance.

2000s–2020s: Gold rallied during financial crises and loose monetary policy, though long plateaus occurred too.

Bottom Line

Gold is a reasonable long-term hedge against inflation and currency debasement. But you need to be particularly careful over the short term (less than one year) because of the price volatility.

It’s not a precise or short-term hedge — performance depends on not just interest rates but also market dynamics. I would also add that there’s a cost to buying, selling, storing and insuring it. So I would not view buying physical gold as a suitable short term (less than 1 year) strategy.

It can be a great diversifier for a portfolio, particularly as it tends to be very liquid so can invariably be converted into cash quite quickly – the same can’t be said for other assets such as property and private equity.

It’s a global asset, so it might also be able to provide some protection from currency volatility.