Things to Look Out For When Buying Gold

Let me start by making it clear: this is not a definitive list of everything you must check before buying gold. There are too many details to cover in a single blog. Instead, think of this as an aide-mémoire — a reminder of some of the right questions to ask.

Always carry out full due diligence and seek advice from a suitably qualified professional.

Anyway, let’s crack on.

Gold has long been considered a safe-haven asset, but buying it — whether in physical form, through funds, or via company shares — requires a bit of thought

1. Buying Physical Gold

Buying physical gold is a lot like buying fine wine: authenticity, storage, and insurance are critical. If you cut corners, you risk ending up with something that may be cheaper to buy…..but could be VERY difficult to sell.

Key questions to ask:

How long has the organisation been in business?

Longevity often signals trustworthiness.What affiliations or memberships do they hold?

Look for respected associations like the LBMA, The World Gold Council, or national chambers of commerce.What are their reviews like?

Check platforms such as Trustpilot — but don’t rely solely on testimonials on their own website (they sometimes put the best ones on it!)How responsive are they?

Call them. Are they professional and quick to respond?Do they offer storage and insurance?

Not every dealer does — confirm upfront. Also find out the cost.Who provides storage and insurance?

Research the partner firm to ensure they’re reputable.Is it allocated or unallocated gold?

Allocated means it’s legally yours; unallocated means it’s in the dealer’s or bank’s name. You are essentially a creditor of their’s.What are the costs?

Factor in buying, selling, and storage/insurance fees. Compare at least two quotes.

Related: How Can I Try and Get Over a 10.6% Return on My Money?

2. Buying a Fund

Funds — whether mutual funds, ETFs, or even crypto-linked gold funds — allow you to gain exposure to gold without holding it physically. They can also enable you to get exposure to many different companies with one investment.

Key questions to ask:

What does the fund invest in?

Physical gold, mining companies (producers and/or explorers), or derivatives? You may find it’s a combination of these – but you should know!What are the minimum investment sizes?

They all vary, £1,000+ might be enough but you need to check.What are the redemption rules?

Is it open-ended (liquid) or closed-ended (restricted exits)? How long does it take to cash out?Are there selling/redemption fees

Can you sell at any time or only at certain times?

What’s the investment strategy?

Capital growth, income, or both?Is it actively or passively managed?

Active = higher fees, potentially more tailored strategy. Passive = often just tracks an index, usually cheaper.What are the fees?

Annual management and possibly performance fees. Make sure they’re in line with industry standards (you will need to look at similar funds)Who is managing it?

Look at both the firm and the individual fund manager’s track record.How large is the fund?

Larger funds often have better liquidity and may have institutional backing. Although smaller funds may have this as well, with a larger fund you may find there are more institutions involved.For ETFs:

Is it physical (holds gold/assets) or synthetic (uses derivatives)?

Is there counterparty risk? If so, what is it and how is it mitigated?

Can the fund be gated?

Unlikely, but possible — meaning withdrawals may be temporarily restricted.

3. Buying Company Shares

Gold companies vary dramatically in size, risk, and stability. In my book and The Gold Program, I use a fantasy football analogy:

Goalkeepers – Large, diversified multinationals (Market value - £15bn+). Lower risk, often pay dividends. Multi commodity

Defenders – Large, focused companies (Market value - £5bn–£15bn). Country- or commodity-specific. Dividends likely. Often focus on a particular commodity.

Midfielders – Smaller producers (Market value - £1bn–£5bn). Higher risk; often reinvesting cash rather than paying dividends. Invariably one commodity.

Forwards – Explorers, so they’re not producing Market value generally less than £1bn. High risk, cash-burning, rarely pay dividends. Whilst they normally explore for a particular commodity, they sometimes find another one!

Key questions to ask:

Can your broker access the shares?

Smaller explorers may be listed on exchanges that your broker doesn’t cover

For explorers (Forwards), have you checked the fundamentals? I would have expected a financier to have already done this for the other positions.

I sse the B.R.I.D.G.E. framework — Balance sheet, Resources, Infrastructure, Grade, Exploration potential. I cover this in my Ebook [Link to E-Book]What are the brokerage costs?

Account fees and transaction charges can eat into returns. Make sure you know what these are.

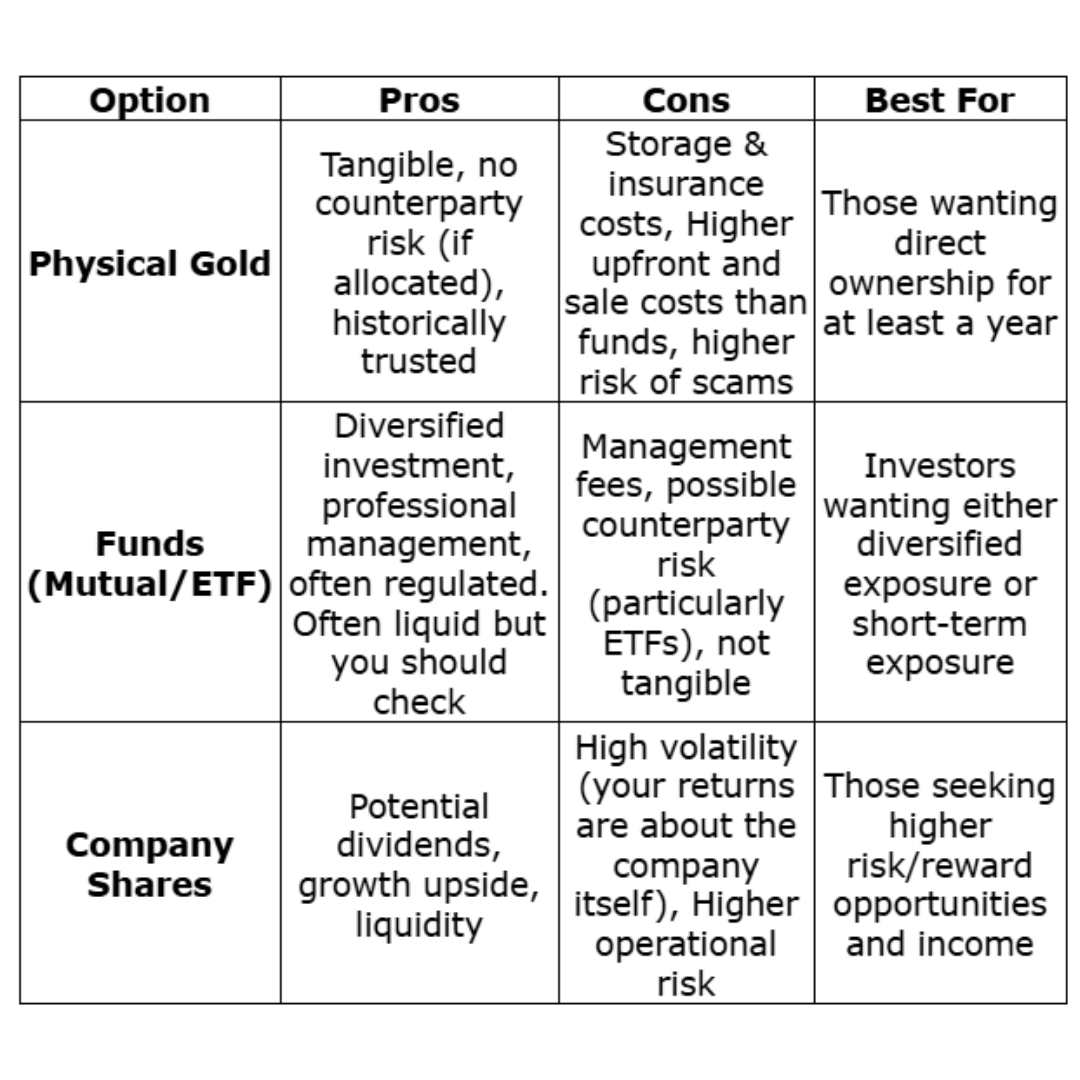

Summary Table: Comparing Gold Investment Options (some high-level points!)

Final Thoughts: Buy with Knowledge, Not Guesswork

Buying gold can be a smart way to diversify and protect your wealth, but only if you know what to look for.

From understanding purity and pricing to choosing reputable dealers, informed decisions are what set confident investors apart.

Keep building your knowledge with our beginner guides and resources designed to help you navigate the gold market safely and with confidence.