The IMF and the Gold price

The International Monetary Fund (IMF) is a global organization with 190 member countries. Its primary purpose is to promote economic stability and growth through lending, policy advice, and technical assistance.

In practice, the IMF acts as a “lender of last resort”: countries generally attempt to stabilize their finances on their own, but when they can’t, they turn to the IMF for support.

Interestingly, while nearly all sovereign states are members, notable non-members include Cuba, North Korea, and Liechtenstein, with some sources also citing Andorra, Monaco, Taiwan, and Vatican City.

Membership generally requires that a country:

Conducts its own foreign affairs,

Has a central bank and currency, and

Is willing and able to meet IMF obligations.

Would a UK IMF Bailout Move Gold?

If the UK were ever forced to seek an IMF bailout, it would certainly signal deep domestic economic distress. However, the direct impact on gold prices would likely be limited. Gold tends to react most strongly to US-driven events, given the US dollar’s global reserve status and the scale of its economy.

The caveat: if such a bailout also involved the US significantly, either directly or indirectly, that could change the dynamics.

Let’s look at it through MIDI – the acronym that I use to try to determine where the Gold price is going:

Market uncertainty

Inflation

Debt

Interest rates

1. Market Uncertainty

Geopolitical risks, wars, tariffs, and political instability all fuel demand for gold. Resolutions typically ease pressure and reduce prices, while escalating tensions can push prices higher.

Although significant global market uncertainty is likely to underpin the Gold price, as I’ve just said, I tend to look at the US.

So if there was an IMF bailout for the UK that didn’t impact the US, then although there could be tremendous market uncertainty in the UK, I doubt there’d be much impact on the Gold price.

2. Inflation

Gold is widely seen as an inflation hedge. While this is strictly speaking not true (the gold price goes up and down and inflation only goes up), it is often viewed as a way of trying to hedge inflation.

It’s worth bearing in mind that since 2000 gold has risen by more than 10.6% annually in GBP terms—well above average inflation.

Taking this thesis one step further, higher inflation generally increases demand for gold, pushing prices upward.

In terms of the IMF, although inflation might be an issue in the UK, if that was not the case in the US, then I would not expect a significant movement in the Gold price (assuming the US are not involved with any bailout).

This could cause UK investors a dilemma. They want to try and shelter some cash because of high UK inflation, but if there’s no concerns in the US about inflation, the Gold price may not do much.

I don’t want to complicate things, but if we get this scenario, I’d also look at the foreign exchange (FX) market. The reason being that the pound could fall against other currencies, so there may be some logic for having gold even though the gold price is quite flat.

3. Debt

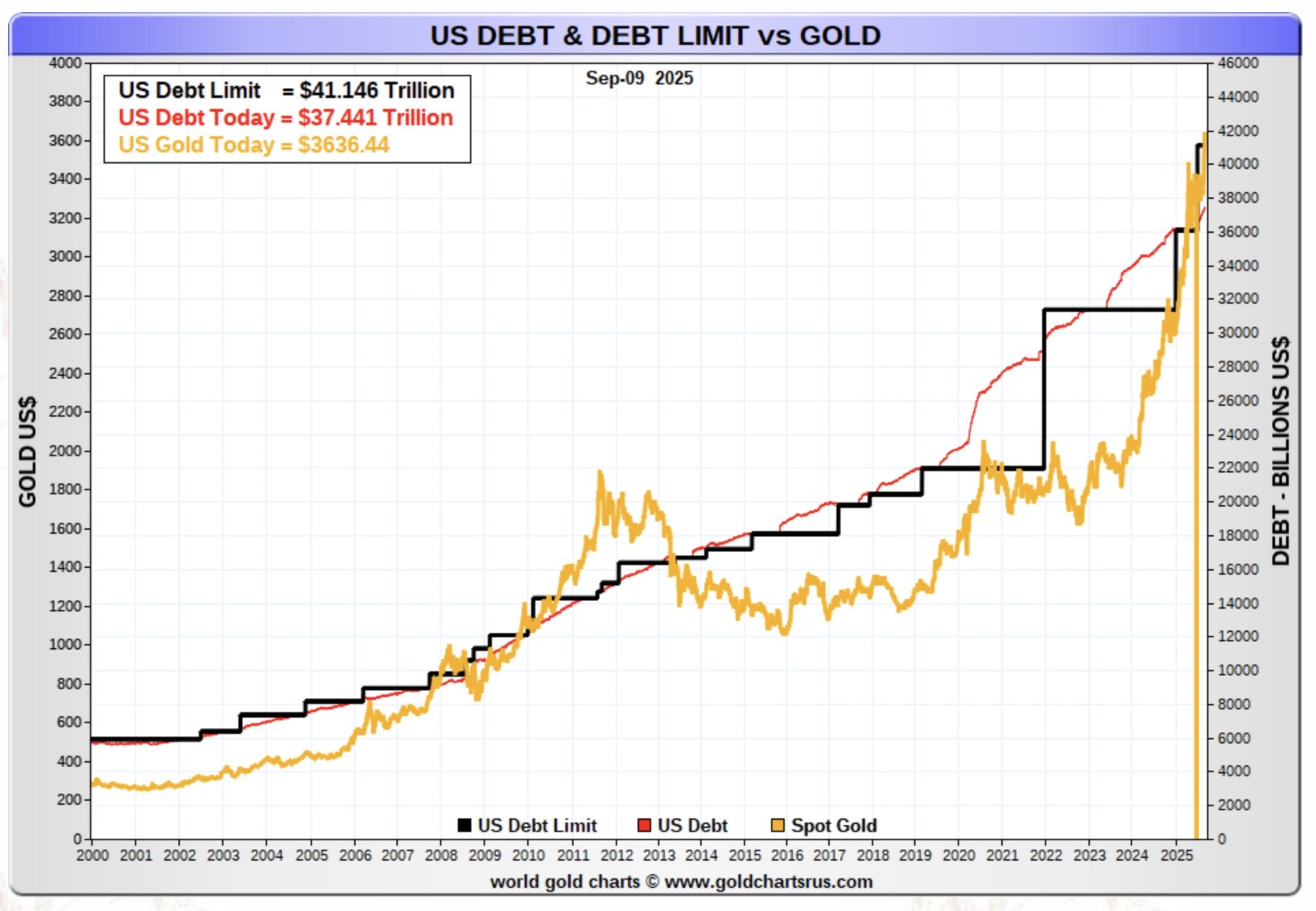

Over time, rising debt levels have correlated with rising gold prices. Take a look at this chart:

With global debt now at extreme levels, we are in “uncharted territory.”

Elevated debt raises uncertainty and increases the cost of servicing obligations, which may create political pressure to lower interest rates. If rates are cut despite high inflation, this could accelerate gold demand.

Higher demand could well lead to a higher price.

From a UK perspective, debt is already elevated, and an IMF bailout would only add to it. But unless this spills into the US, the effect on gold prices might be muted. Again, sterling weakness could make gold attractive for UK investors even if the gold price is flat.

4. Interest Rates

Typically, higher rates discourage gold (since gold offers no yield), because people would rather get say a 5% yield on a bond rather than a 0% yield on their gold.

The yield being guaranteed, any movement in the price of gold is clearly not guaranteed. It could go up or down.

However, lower rates tend to support the gold price. Think about it, if you’re getting less yield, you’re not only “giving up less”, but if you’re also worried about inflation, you might be more inclined to take a risk on the Gold price (you can see how interconnected the various elements are!).

With debt so high, interest rate decisions may become more politically charged, increasing uncertainty—and thus gold’s appeal.

In the IMF context, what matters most is the US interest rate environment. If US rates fall, gold is likely to rise. A UK-only bailout would probably have little effect on US interest rates and therefore the Gold price.

The IMF Angle

So, circling back:

A UK-only IMF bailout would likely be seen as bad news domestically but may not move gold dramatically. It could make it (gold) more difficult to buy domestically, because people might want more (or some) of it. But as it’s a global rather than UK asset, the price movement could be relatively muted.

However, if US involvement is triggered—whether directly or indirectly—then the gold market could react strongly.

In any bailout scenario, keep an eye on the pound. If sterling (the pound) weakens, gold may become attractive even if its global price is flat, as long as it falls less than sterling.

The key is always to ask: does this event affect the US? If the answer is yes, then it’s probably more relevant for gold.

So although any requirement to have to use the IMF for a bailout is clearly bad, if it doesn’t involve the US (which it probably will), then I’d be careful about making any assumptions about what might happen to the Gold price.